TCE predicts that the high-powered incentives of market forms of governance impede adaptability among transacting parties, and that markets are thus ill equipped to deal with these situations of high bilateral dependency.

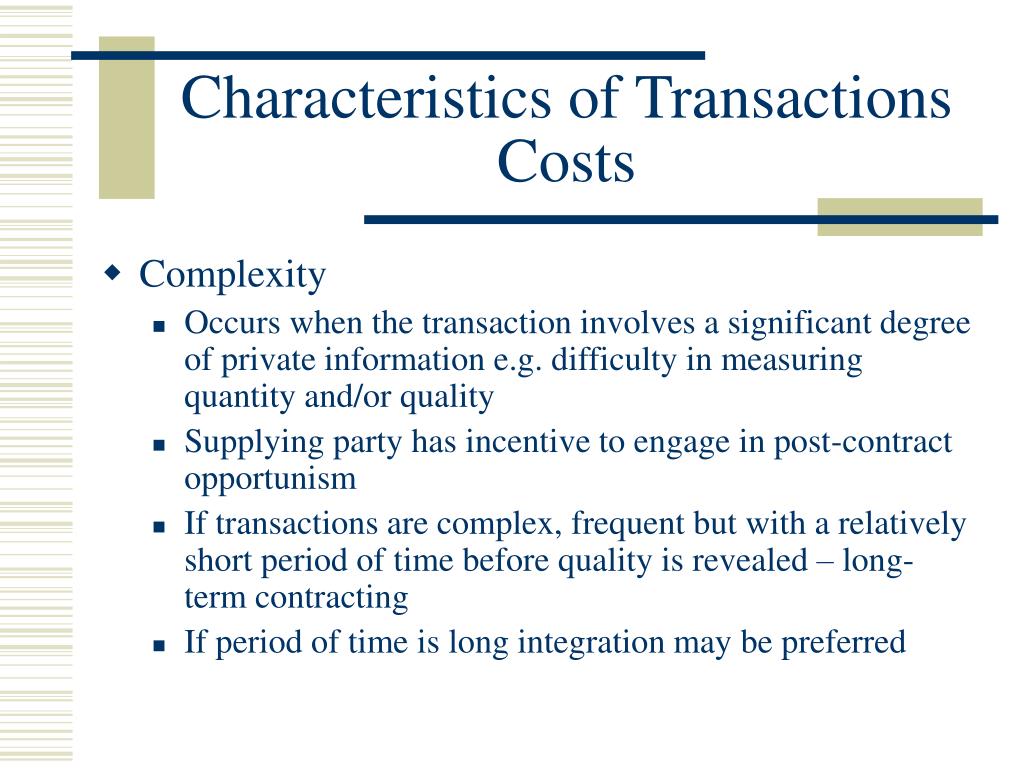

On the other hand, learning to speak Navajo, a rare Athabaskan language spoken in the southwest United States, could be highly asset-specific (human asset-specific, specifically), since your investment return (being able to communicate with others) is high with the few Navajo-speaking people, but almost zero otherwise.Īs asset specificity increases, the ability to reuse the resources decreases, which increases bilateral dependency and contracting hazards between parties. Basically, asset specificity refers to the extent to which a party is "tied in" in a two-way or multiple-way business relationship.įor example, learning to speak English, one of the most widely understood languages of the world, is a highly asset-unspecific investment, since your investment will be likely to have equal returns (being able to communicate with others) across a variety of different settings. TCE maintains that there are ‘rational economic reasons’ for choosing the means of governing transactions (Williamson, 1985: 52). The principal attributes of transactions, according to TCE, are asset specificity, uncertainty, and frequency.Īsset specificity of a transaction refers to the degree to which the assets used in support of the transaction can be redeployed to ‘alternative uses and by alternative users without sacrifice of productive value’ (Williamson, 1991b). Rather than relying on the courts, parties within a hierarchy resolve disputes internally.Hybrid requires information disclosure when adaptation occurs.Hybrid forms are supported by more ‘elastic’ contract law, which is more adaptive than classical contract law.The identity of the parties matters, in the sense that each could not be replaced without cost by the other.Parties to the transaction maintain autonomy but are bilaterally dependent.Market transactions are governed by formal terms that are interpreted in a legalistic way, and are characterized by ‘hard bargaining’ between parties.Transacting parties are irrelevant and no dependency relation exists between them.Williamson (1991b) identifies three alternate forms of transaction governance which are supported by different forms of contract law, and each employs its own coordination and control systems: The theory’s central claim is that transactions will be handled in such a way as to minimize the costs involved in carrying them out. The means of effecting the transaction is the principal outcome of interest (Williamson, 1985: 1).

TCE, at its core, focuses on ‘transactions and the costs which attend completing transactions by one institutional mode rather than another’ (Williamson, 1975: 1–2). In this study it has been tried to reconcile the gap between the prominence of TCE and the lingering doubts about it. TCE (Transaction cost economics) which has been well developed by Williamson (1975) has had many debates on the validity based on empirical studies and applicability in the decision making systems (Maron & Goshal 1996). Previous studies have almost been rather narrative than systematic approach (e.g., Mahoney, 1992 Joskow, 1993 Shelanski and Klein, 1995).

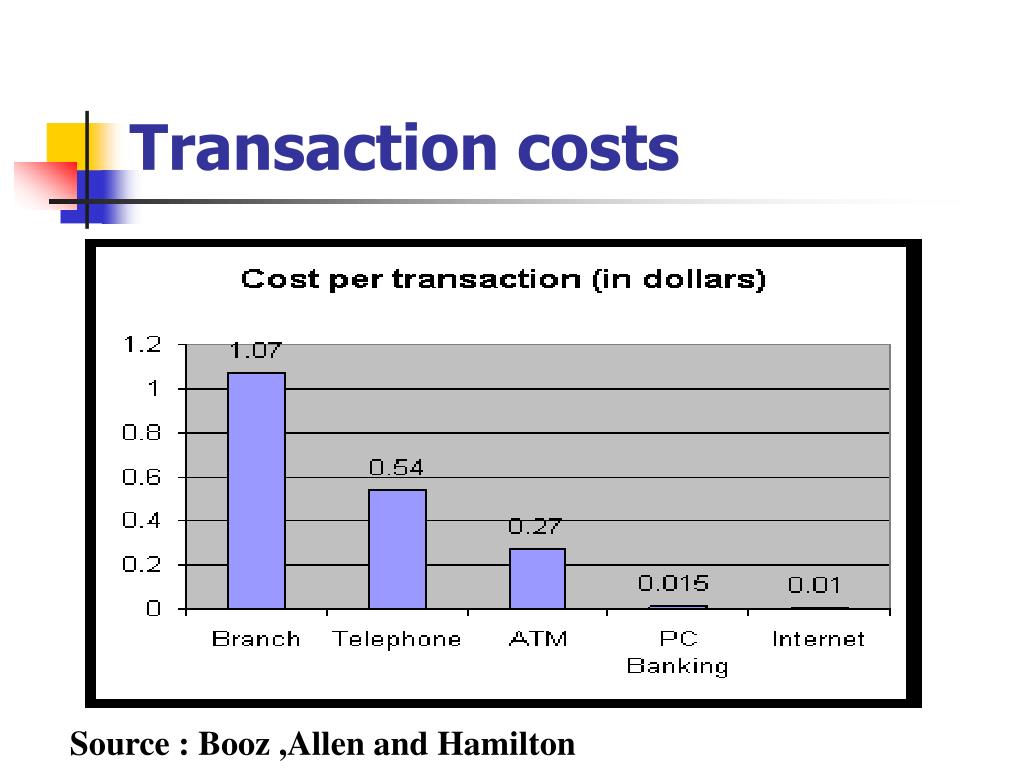

The concept can also be used to improve the efficiency by deploying initiatives to reduce transaction costs between the business partners and increase the benefits. The importance of transaction costs economics lies in its impacts on determination of the right business relation between two entities of either market or an organizational recruitment form (hierarchy). Transaction costs is the cost associated with exchange of goods or services and incurred in overcoming market imperfections. Transaction costs cover a wide range: communication charges, legal fees, informational cost of finding the price, quality, and durability, etc., and may also include transportation costs. Ref: A SYSTEMATIC ASSESSMENT OF THE EMPIRICAL SUPPORT FOR TRANSACTION COST ECONOMICS, ROBERT J.

0 kommentar(er)

0 kommentar(er)